Paco Rabanne 1 Million Set (EdT 100ml + DS 150ml) a € 81,15 (Offerte Black Friday 2023) | Miglior prezzo su idealo.it

3349668579839 - Eau de Parfum - corpoecapelli - Paco Rabanne One Million Parfum Profumo Uomo Spray 100ml

3349668601073 - Eau de Parfum - corpoecapelli - Paco Rabanne One Million Elixir Parfum Intense Profumo Uomo Spray 50ml

Paco Rabanne Perfume 1 One Million Eau De Toilette Mens Cologne Mini Parfum 5 ml 3349668509416 | eBay

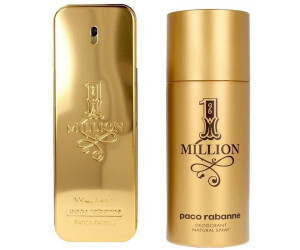

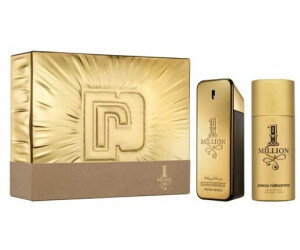

Paco Rabanne 1 Million Set (EdT 100ml + DS 150ml) a € 81,15 (Offerte Black Friday 2023) | Miglior prezzo su idealo.it

Paco Rabanne 1 Million Set (EdT 100ml + DS 150ml) a € 81,15 (Offerte Black Friday 2023) | Miglior prezzo su idealo.it