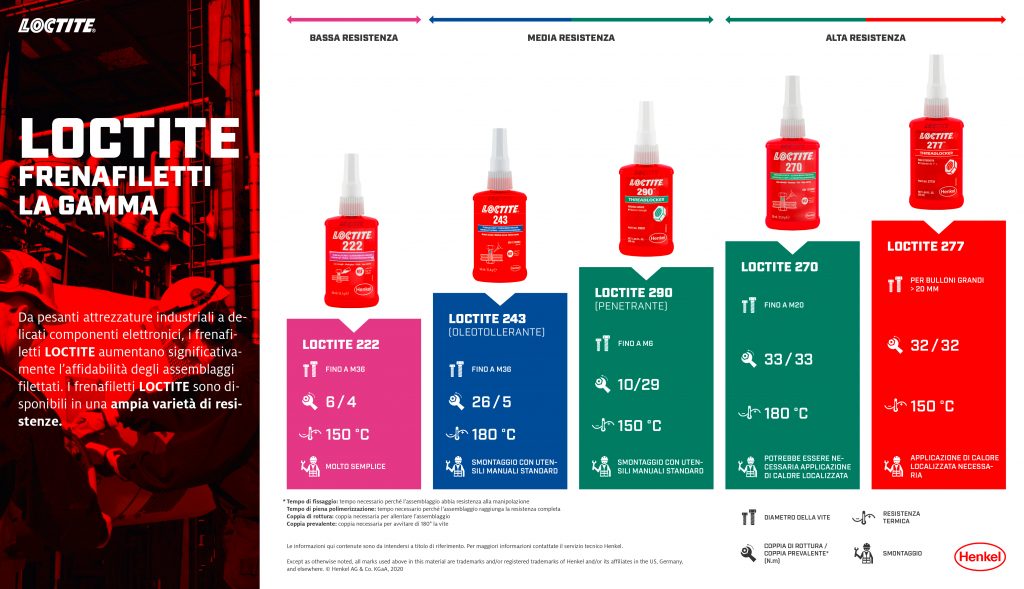

1370555 LOCTITE 243 Frenafiletti Blister pack, Bottiglia, Contenuto: 5ml, Blu, Di media solidità 1370555 ❱❱❱ prezzo e esperienza

Frenafiletti Blu 10ml 243 Frenafiletti tollerante all'olio a Media Resistenza, Colla per Viti sigillante Adesivo anaerobico, frenafiletti a Prova di perdite : Amazon.it: Fai da te

Loctite 1330255 243 Frenafiletti blu a media resistenza, 360 F, capsula da 0,5 ml | Vendite di strumenti JB