Coperchio Pompa Freno Anteriore Beta cod. 12.55916.000 Beta ALP / Enduro / Motard / Urban 50 > 350cc 2007>

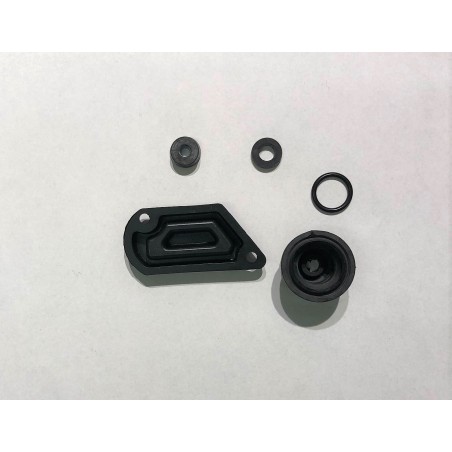

Kit Gommini Pompa Freno Anteriore Beta cod. 20.08274.000 Beta ALP / RR Enduro / RR Motard 50 / 125 / 200 / 350cc 07>

PonziRacing - Scooter e Moto 50cc > Ciclistica > Leve Scooter e Moto > Beta > Coppia leve freno frizione Doppler ergal CNC rosse Beta RR 50cc pompa Grimeca

Pompa Freno posteriore Naraku Beta RR 50 / 125 05- Alp 200 07- / Alp 4.0 05- / M4 350 00- acquista | MAXISCOOT.com

-550x550w.jpg)