Kit Carburatore – po201.2103 – CP 21 mm per Vespa 125 Primavera, ET3, Small Frame : Amazon.it: Auto e Moto

CARBURATORE SHBC 19/19 mm dellorto vespa 50/125 primavera-special piaggio cod.773 : Amazon.it: Auto e Moto

Carburatore dell'Orto 19:19 per VESPA 125 ET3 - Rondelle piane grower 12215 : Vendita Ricambi e accessori scooter vespa e moto

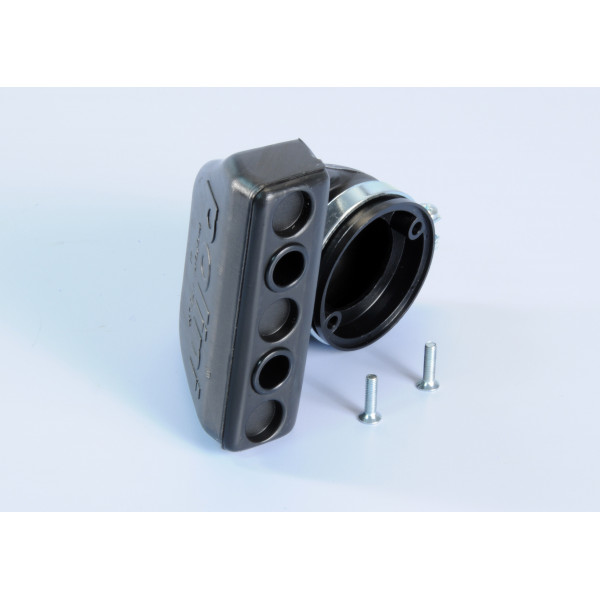

Impianto alimentazione completo PINASCO carburatore d.22 RIGIDO - Vespa 50/90/125 PRIMAVERA-ET3 2 fori | Vespatime