Hudson Reed -Sistema Doccia con Miscelatore Termostatico Incasso a 3 Vie (Ottone Cromato) - Gruppo con Soffione

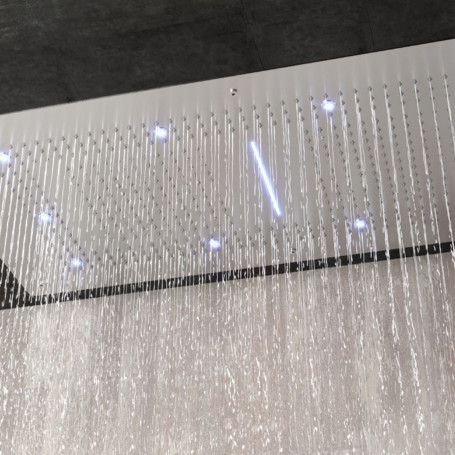

Soffione doccia led a soffitto installazione da incasso con cascata acciaio inox quadro | Leroy Merlin

Frattini 9060772 Docce Soffione doccia a parete rettangolare con getto pioggia e cascata ad incasso - bianco opaco | Vieffetrade

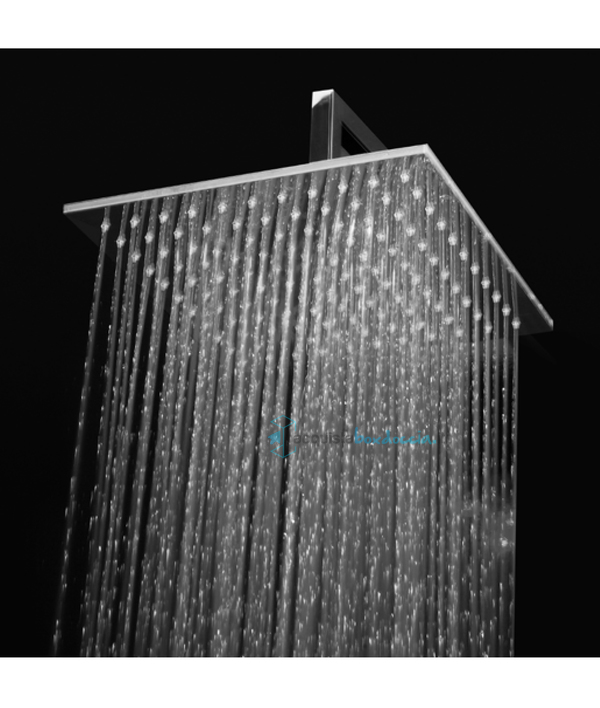

UIEMMY Sistema Doccia Set Rubinetto Doccia Incasso LED Orb Nero LED Soffione Doccia a Pioggia Soffione a Cascata Rubinetto Miscelatore a 3 Vie Doccia da Bagno, Set Completo da 20 Pollici :

Vendita pacchetto doccia completo con soffione doccia,soffione a cascata,mix incasso e kit doccia con supporto - serie 500 emotions | Acquistaboxdoccia.it

Wall Kit A Parete Da Incasso A Muro Acciaio Inox + Soffione Doccia a Parete Acciaio Inox Punta Quadrata Con Cascata

.jpg)

.jpg)