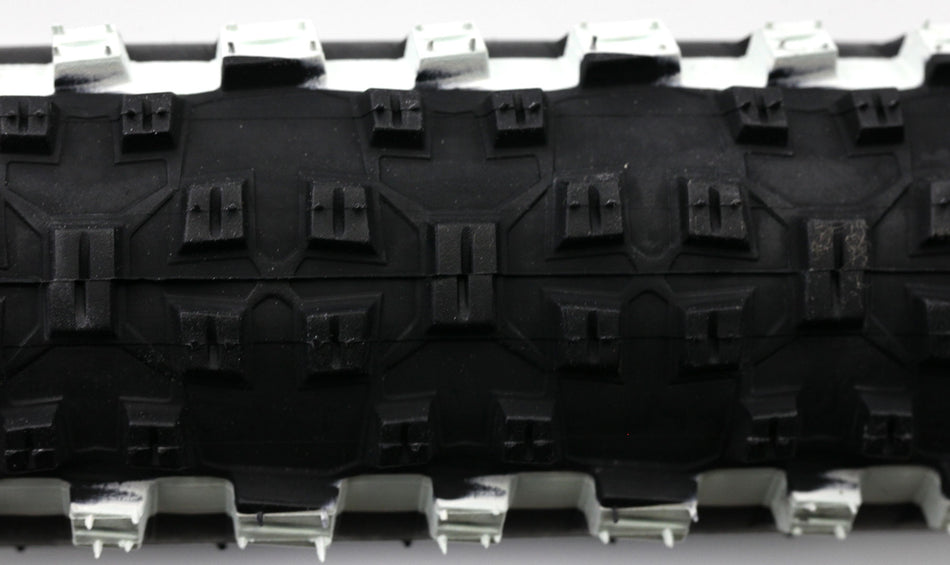

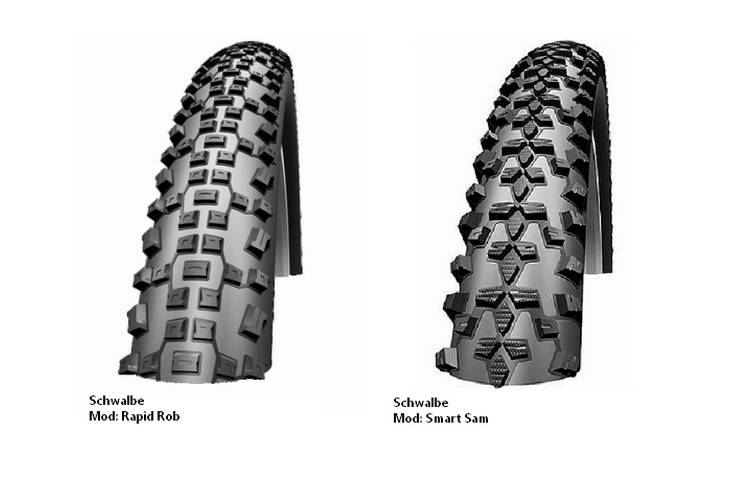

COPERTONE RAPID ROB k-guard 26x2.25 rigido nero 340826225 SCHWALBE copertone mtb EUR 23,90 - PicClick IT

Schwalbe Rapid Rob - Set di 2 pneumatici da mountain bike, 26 x 2,10 cm, con valvole per bici da corsa Schwalbe : Amazon.it: Sport e tempo libero