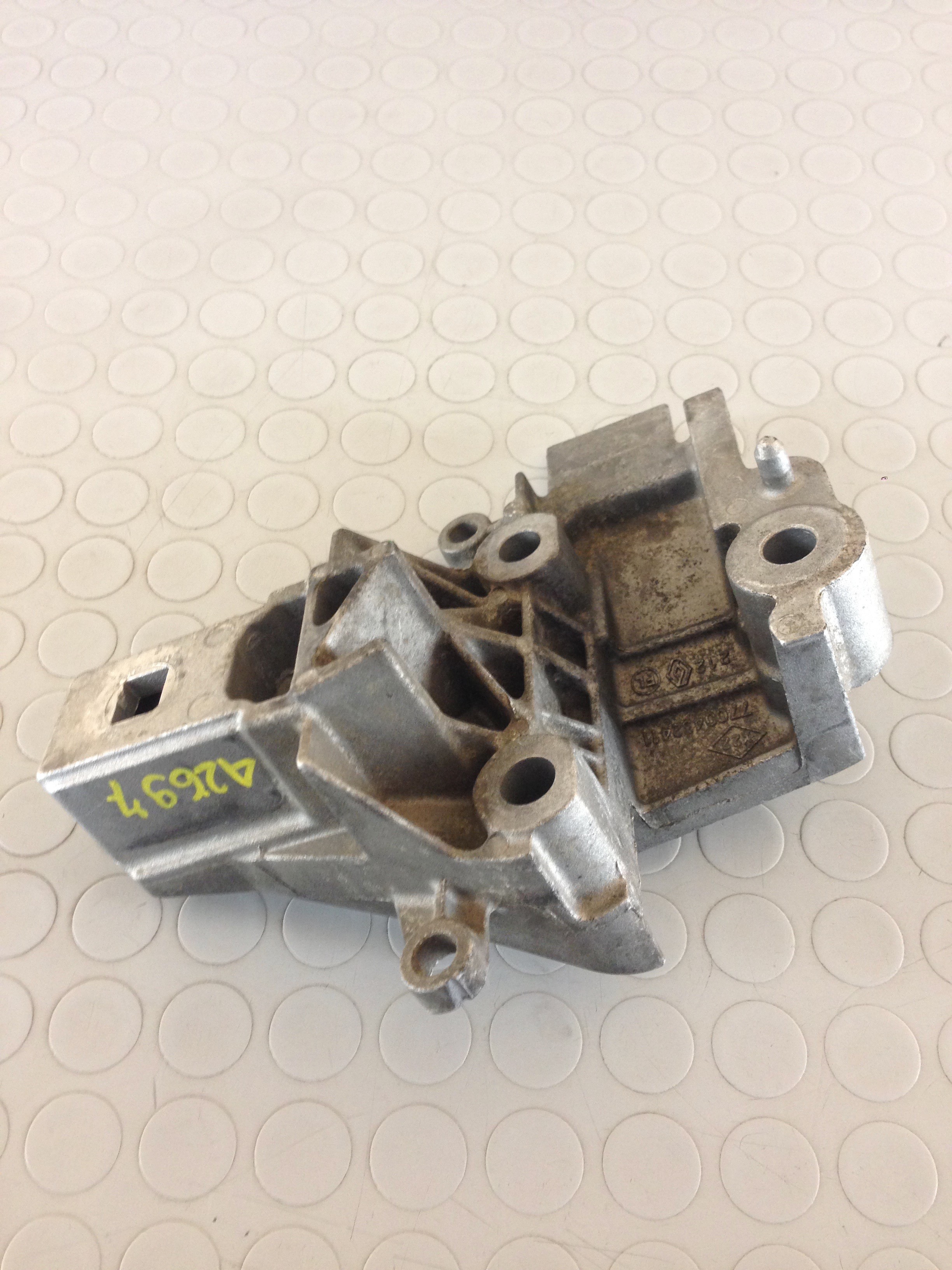

SUPPORTO MOTORE RENAULT CLIO I/II, KANGOO, MEGANE 1.2cc/1.4cc/1.8cc/DIESEL LATO DESTRO DISTRIBUZIONE - Autoricambi Cimino Snc

Supporto motore sinistro compatibile con Renault Kangoo/Grand Kangoo 8200043084 (usato) (id:sidlp401687) : Amazon.it: Auto e Moto

RENAULT KANGOO (2000) 1.9 DIESEL 47KW FURGONATO SUPPORTO MOTORE ANTERIORE DESTRO 7700432411 - Autodemolizione Trentaricambi

Supporto biella resistente alla torsione 7700426193 utilizzato per accessori manicotto tampone esterno motore Renault Kangoo Clio2 - AliExpress