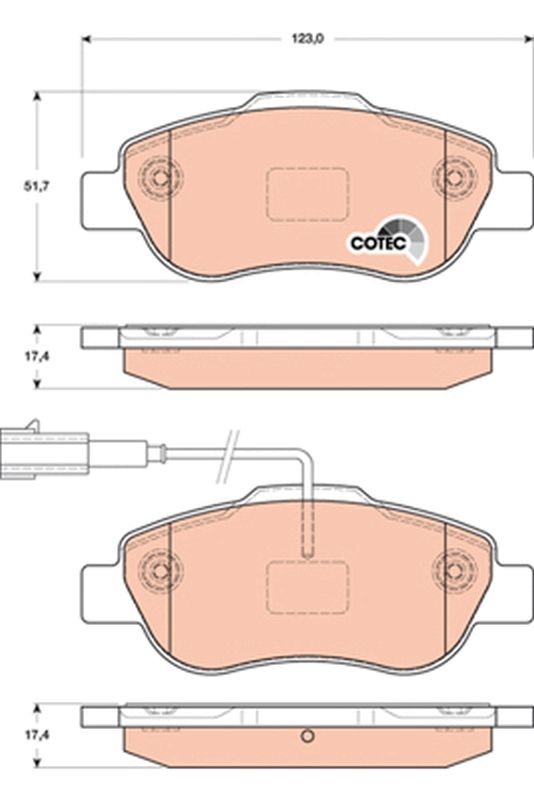

Pastiglie freni per Fiat Fiorino I,II Pick-up, Van (1977-1988) - Tomex - TX 10-23 (asse anteriore) | Negozio Carmager

Pastiglie freno per FIAT FIORINO posteriore e anteriore ▷ online a un prezzo basso ▷ AUTODOC catalogo

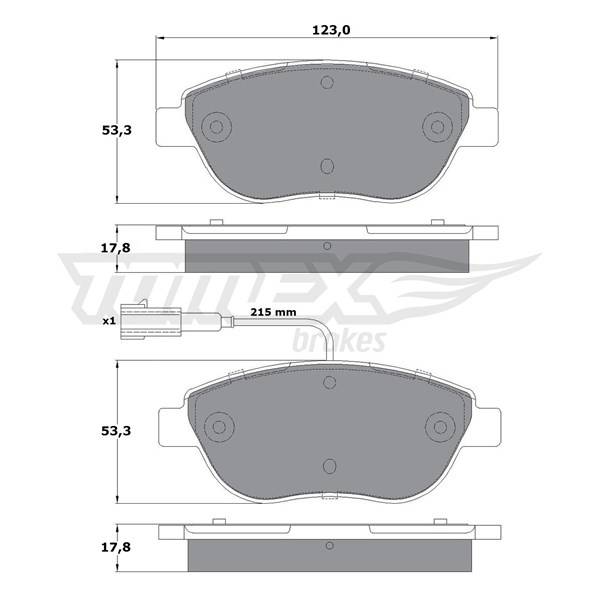

Pastiglie freni per Fiat Fiorino IV Station Wagonvan, Van (2007-....) - Tomex - TX 12-48 (asse anteriore) | Negozio Carmager

Pastiglie freno per FIAT FIORINO posteriore e anteriore ▷ online a un prezzo basso ▷ AUTODOC catalogo

Pastiglie freni per Fiat Fiorino IV Station Wagonvan, Van (2007-....) - Tomex - TX 12-48 (asse anteriore) | Negozio Carmager

VALEO 301426 Kit pastiglie freno FIRST, Assale anteriore, Con contatto segnalazione usura, con lamierino anticigolío ▷ AUTODOC prezzo e opinioni

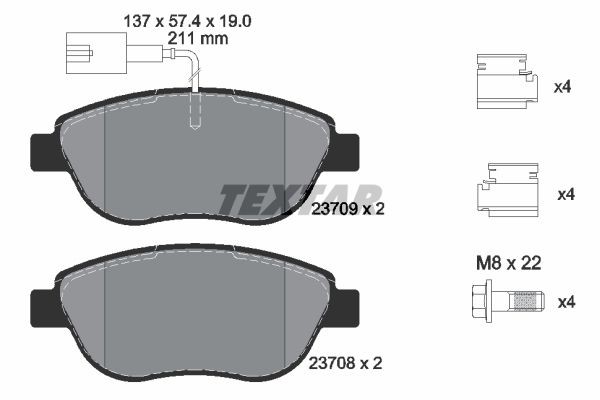

P 23 137 BREMBO 23708 Kit pastiglie freno Con contatto segnalazione usura, con bulloni pinza freno, con accessori 23708, 23709 ❱❱❱ prezzo e esperienza

KIT DISCHI FRENO + PASTIGLIE BREMBO FIAT FIORINO QUBO 1.3 Multijet 55KW 75CV EUR 102,89 - PicClick IT

Pastiglie Freno Compatibili Per Fiat Fiorino (146) | Palio (178) | Siena (178) art.886X | Biba-Ricambi

Pastiglie freno per FIAT FIORINO posteriore e anteriore ▷ online a un prezzo basso ▷ AUTODOC catalogo

Pastiglie freni per Fiat Fiorino I,II Pick-up, Van (1977-1988) - Tomex - TX 10-23 (asse anteriore) | Negozio Carmager

Pastiglie + dischi freno per Fiat Fiorino IV Station Wagonvan, Van (2007-....) - Tomex - TX 12-48 + TX 70-56 (asse anteriore) | Negozio Carmager