L-acoustics SB218 | 800 EUR - Gebrauchte-Veranstaltungstechnik.de - Der Marktplatz für gebrauchte Veranstaltungstechnik

L-Acoustics SB218 | 2000 EUR - Gebrauchte-Veranstaltungstechnik.de - Der Marktplatz für gebrauchte Veranstaltungstechnik

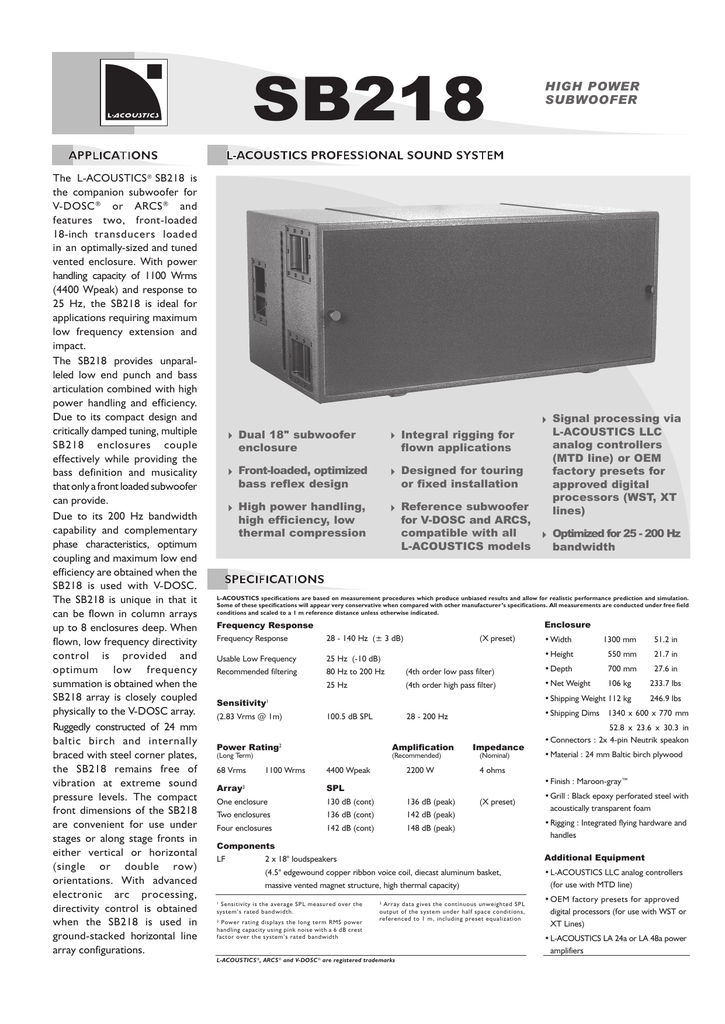

Used, Second hand L-Acoustics V-DOSC-SB218 Sound Package - Used Audio, Lighting and Video Equipment - Usedful.eu