Serratura europea, vantaggi e funzioni - Blog - CoMETA S.p.A. - Elettroserrature, Elettromagneti, Cilindri magnetici, Cabine antirapina, Protezione valori

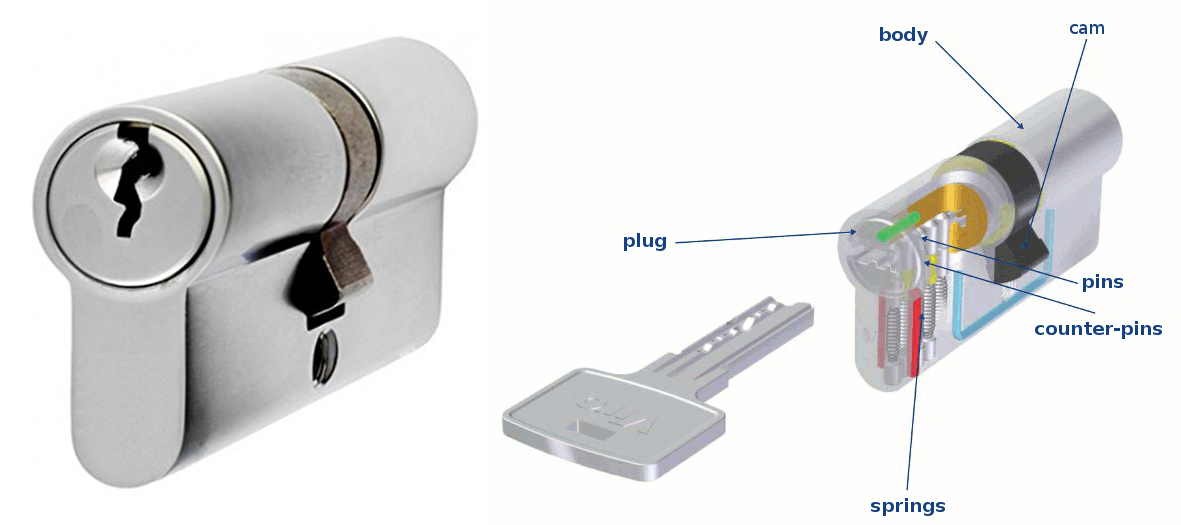

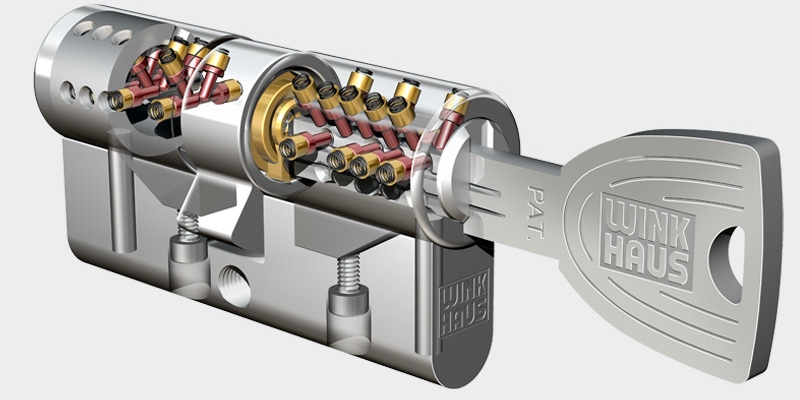

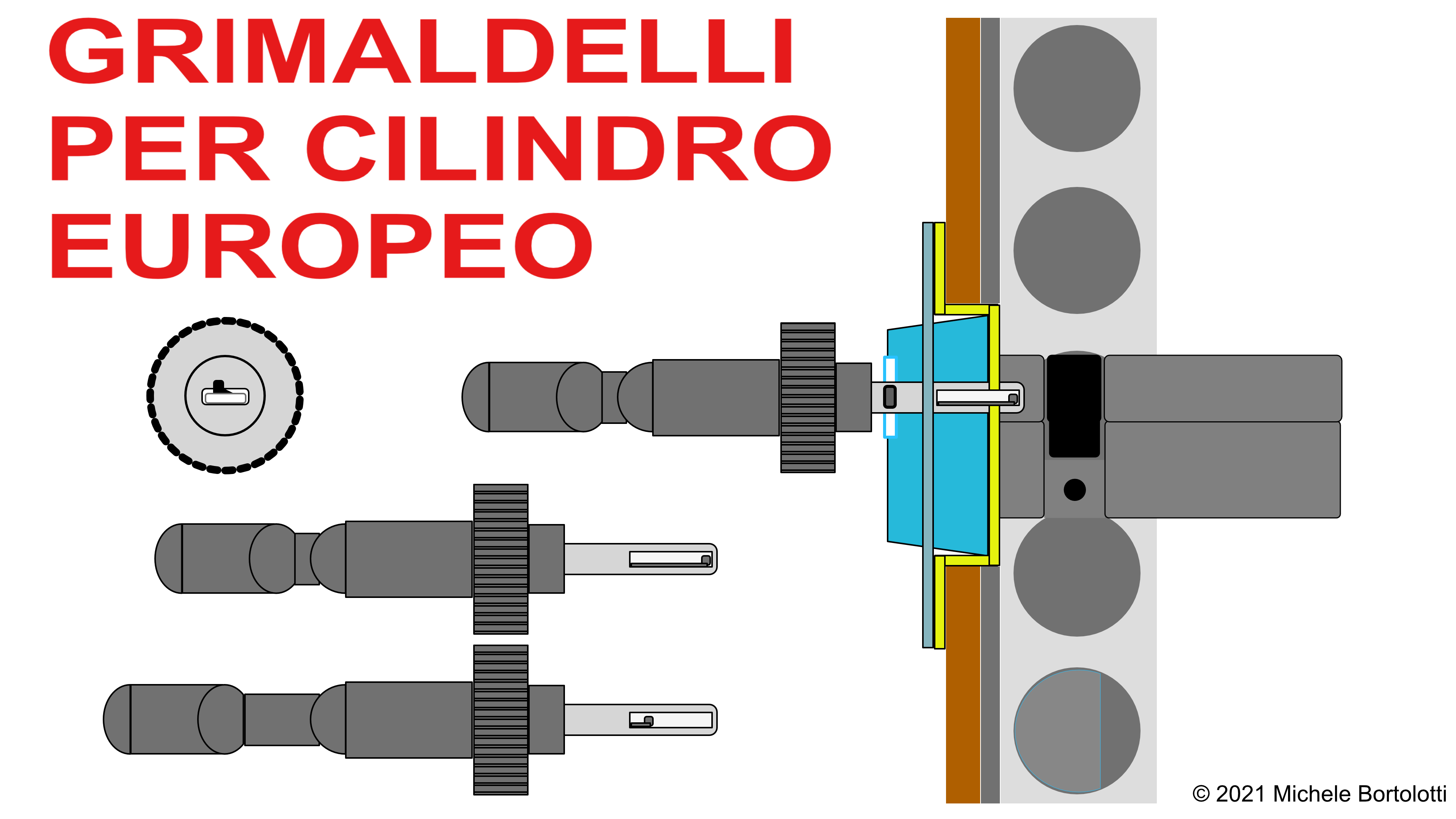

Cilindri europei di massima sicurezza – Sostituire serratura porta blindata da doppia mappa a cilindro europeo