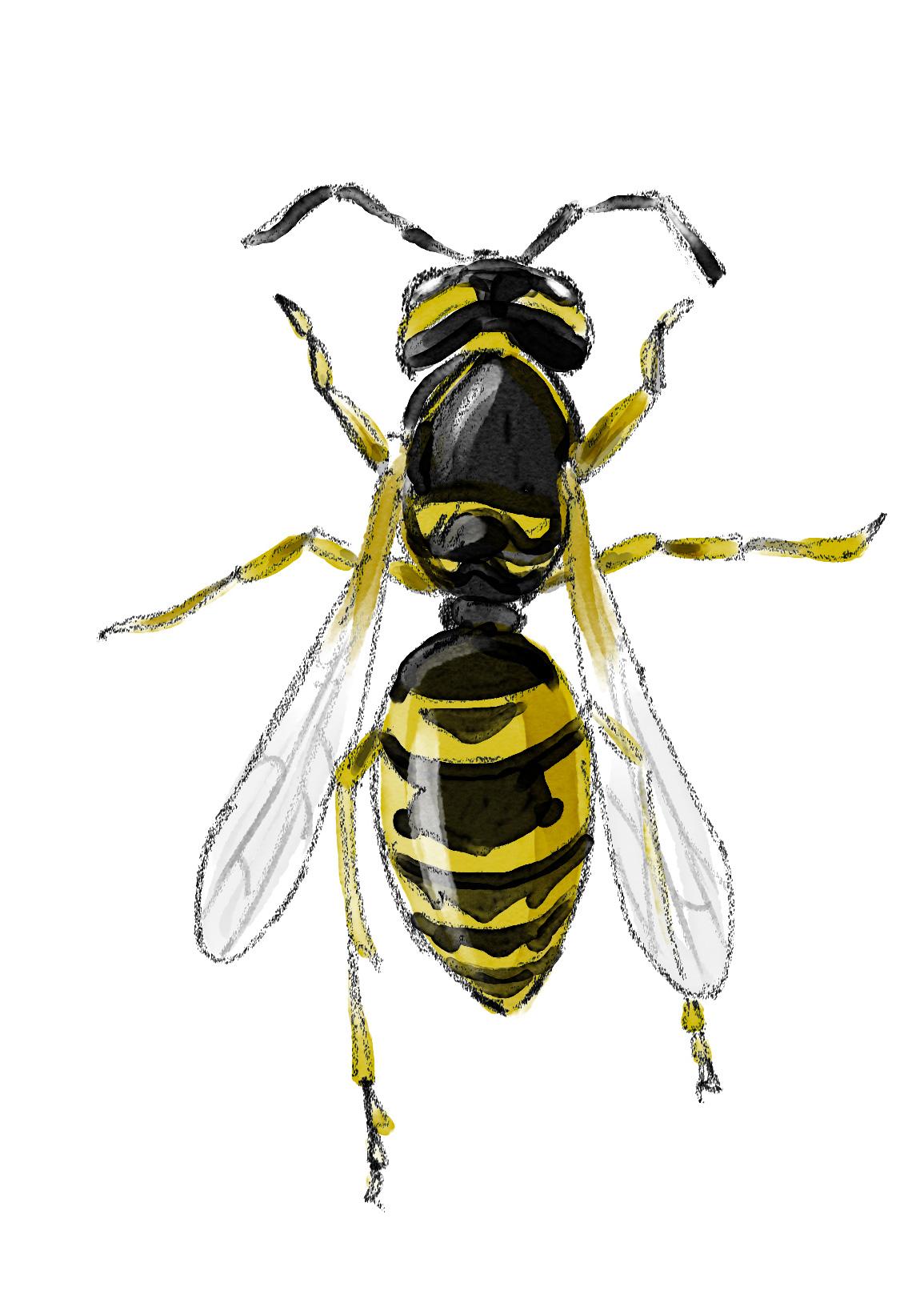

Commenti Memorabili 2.0 - Questa è una vespa. Quando te incontri una vespa non stai più di tanto lì a discutere. Quando la incontri, fuggi e stai muto. | Facebook

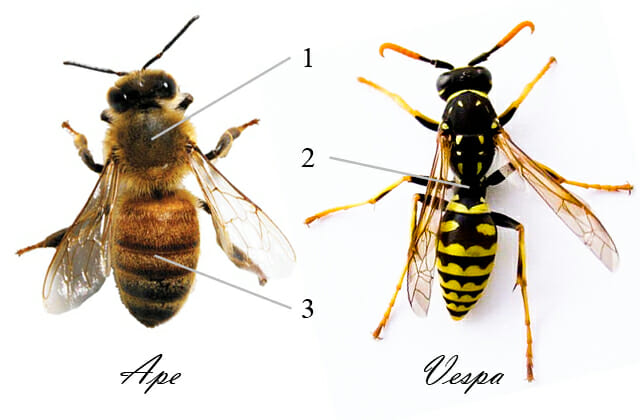

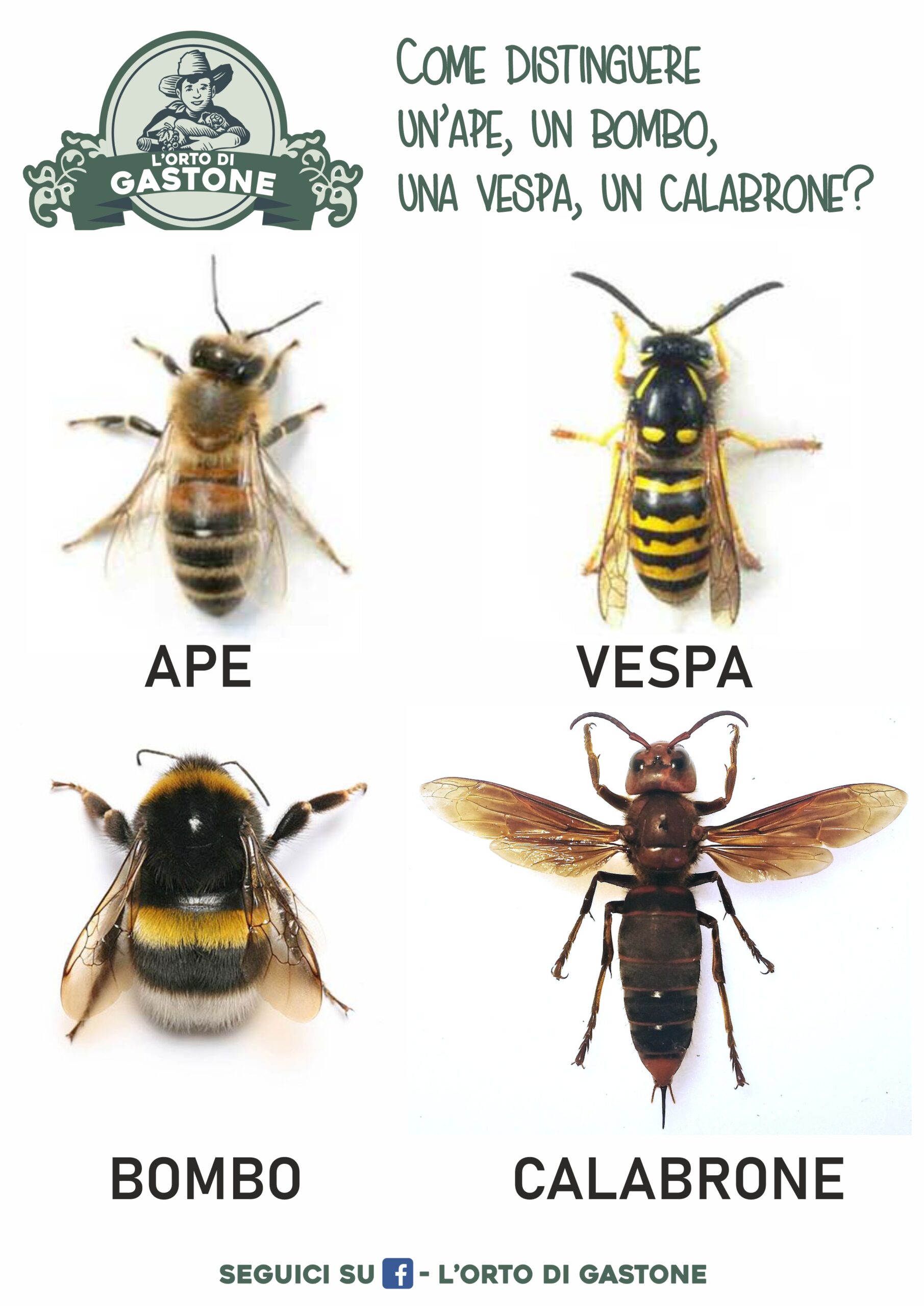

Apicoltura Sascau - * Differenza tra ape, vespa, calabrone, bombo e rispettive punture. * L'ape (Apis Linnaeus) appartiene ad un genere di insetti sociali della famiglia Apidae, che comprende ben 27 specie