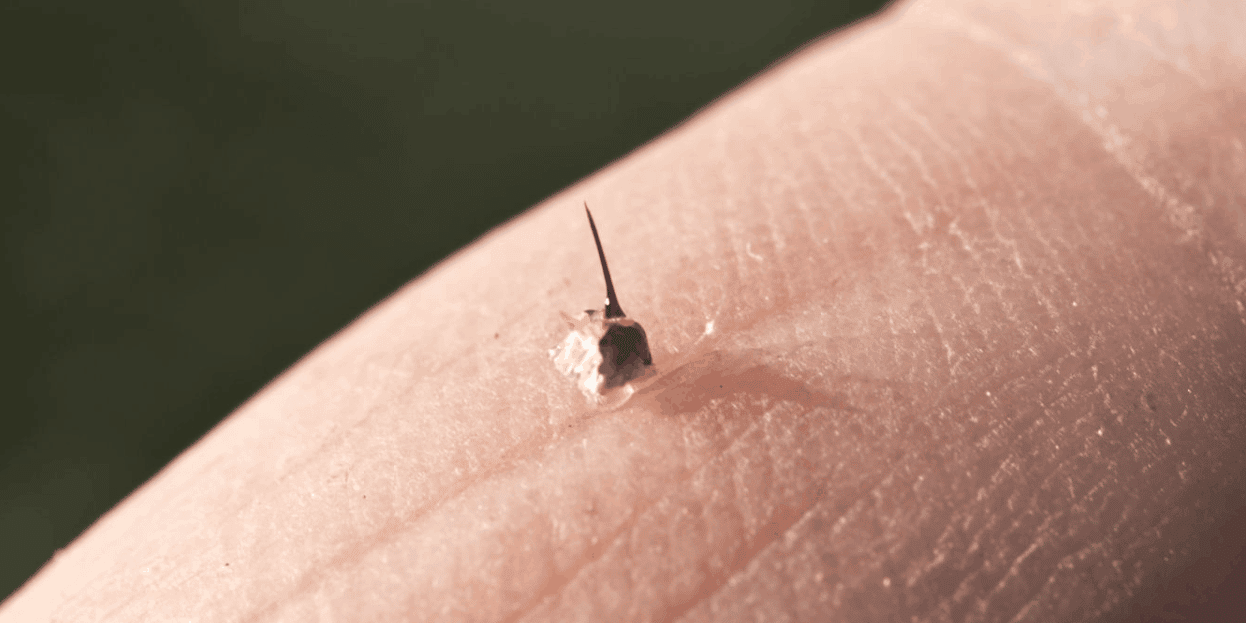

Azienda Usl di Parma - Dopo il tragico evento della donna morta a Torrile di shock anafilattico per ripetute punture di vespe, desideriamo ricordarvi cosa fare nel caso un #imenottero (#api, #vespe

Punture di api, vespe, calabroni e formiche - Lesioni e avvelenamento - Manuale MSD, versione per i pazienti