Caldaia a condensazione Vaillant ecoTEC Plus VMW 30 CS/1-5 0010022022 Metano o Gpl Completa di kit fumi

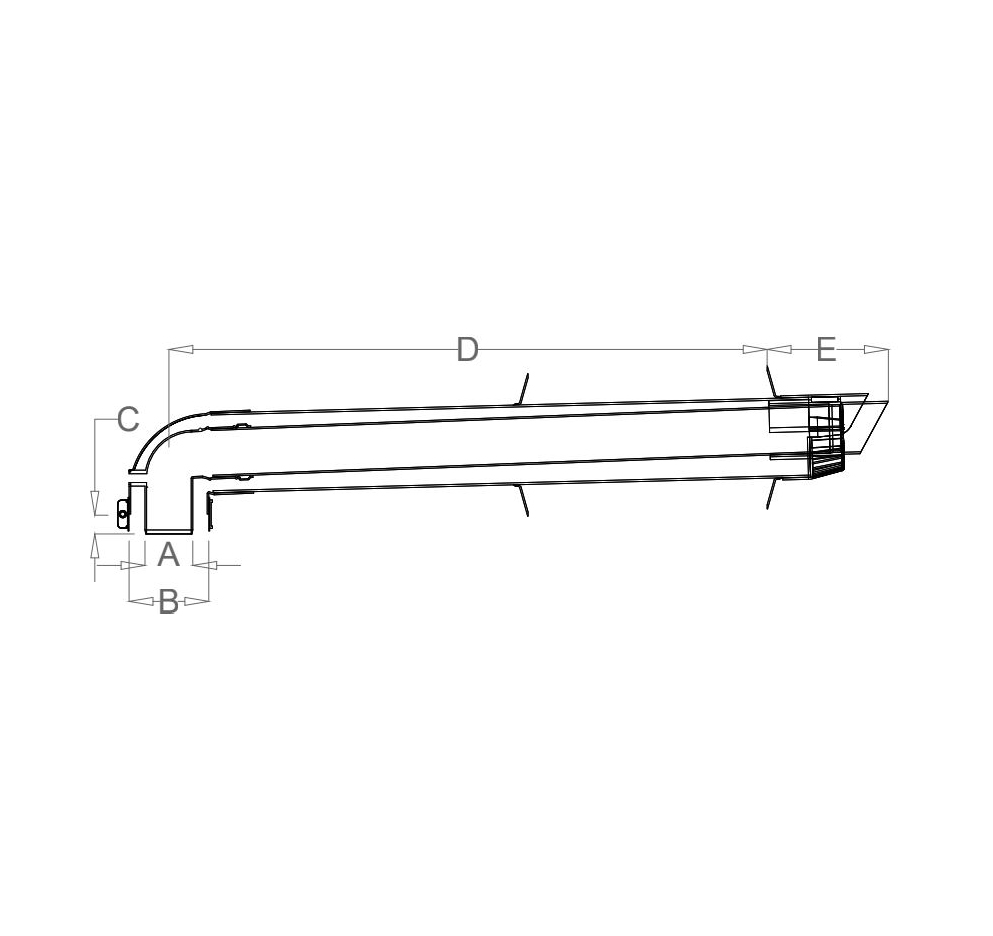

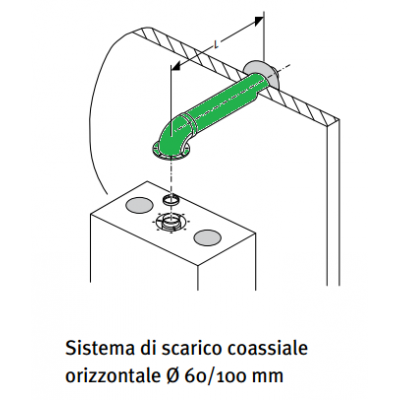

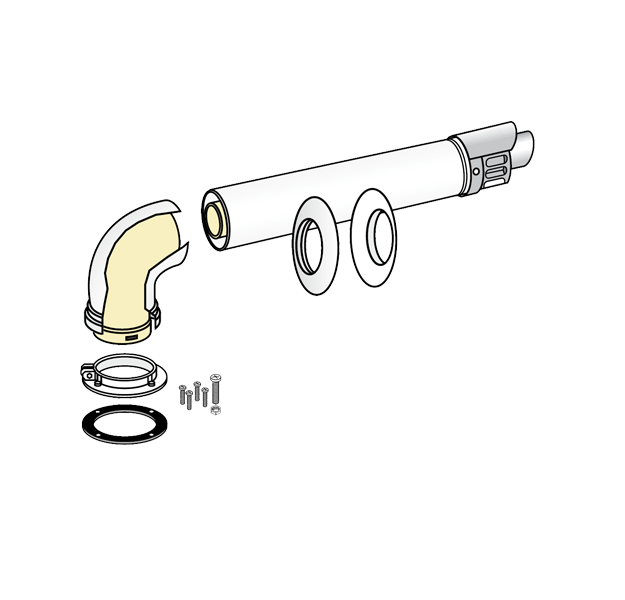

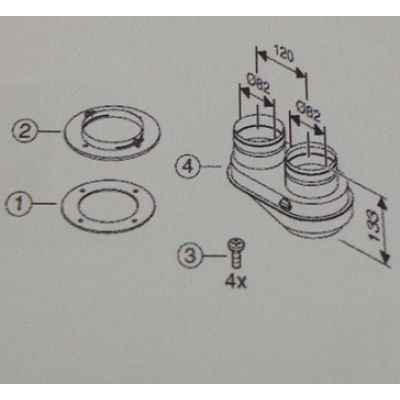

Hermann Saunier Duval Kit scarico Fumi coassiale orizzontale Ø 60/100 per caldaia a condensazione - Centro Edile Srl

BIASI - CALDAIA CONDENSAZIONE BASICA COND 25S NOx6 GPL CON KIT FUMI a scelta | Caldaie a condensazione, Caldaie a Gas | Miele Arredo

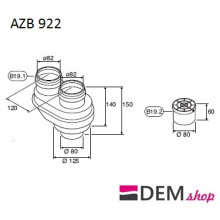

22497 - Kit scarico fumi coassiale Ariston Chaffoteaux 1 mt orizzontale 60/100 3318073 - 1 Termo Clima Ricambi