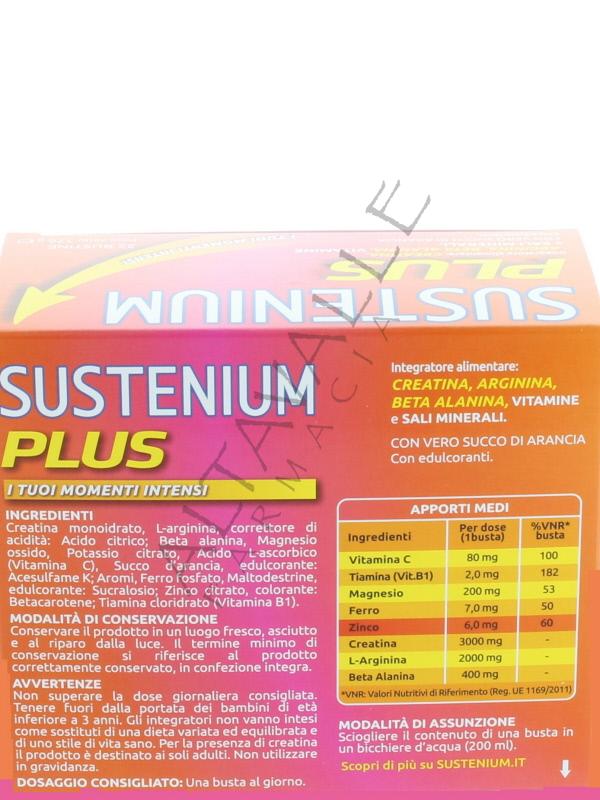

Sustenium Plus Intensive Formula - Integratore alimentare energizzante - 22 bustine | Farmacia Guacci

Sustenium Plus - lntegratore energizzante a base di uno specifico complesso di aminoacidi, vitamine e minerali. Per la tua energia fisica e mentale. Confezione da 22 bustine : Amazon.it: Cancelleria e prodotti

INTEGRATORI :: MULTIVITAMINICI :: SUSTENIUM PLUS INT FORM 22BUST - Farmacia Bonelli - Farmacia di Savigliano

Sustenium Plus Intensive Formula - Integratore alimentare energizzante - 22 bustine | Farmacia Guacci

Sustenium Plus 50+ - Integratore energizzante adulti 50+ con complesso antiossidante ACTIFUL®, vitamine e minerali. Per la tua energia fisica e mentale. Confezione da 16 bustine : Amazon.it: Cancelleria e prodotti per ufficio