Ma-Fra, Quick Detailer interni, Pulitore Igienizzante Superfici Auto senza Alcool per Pulizia e Igienizzazione Interni Auto senza risciacquo, 500ml : Amazon.it: Auto e Moto

Pulitore pelle profumato ML750 detergente specifico delicato - Lindo e Unto Pulizia Auto Cruscotti e Interni Rhutten - Af Interni Shop

Rhütten Azione Disodorante Pulitore Schiumogeno per la Pulizia dei Tessuti, Dotato di Spazzola, 400 ml : Amazon.it: Salute e cura della persona

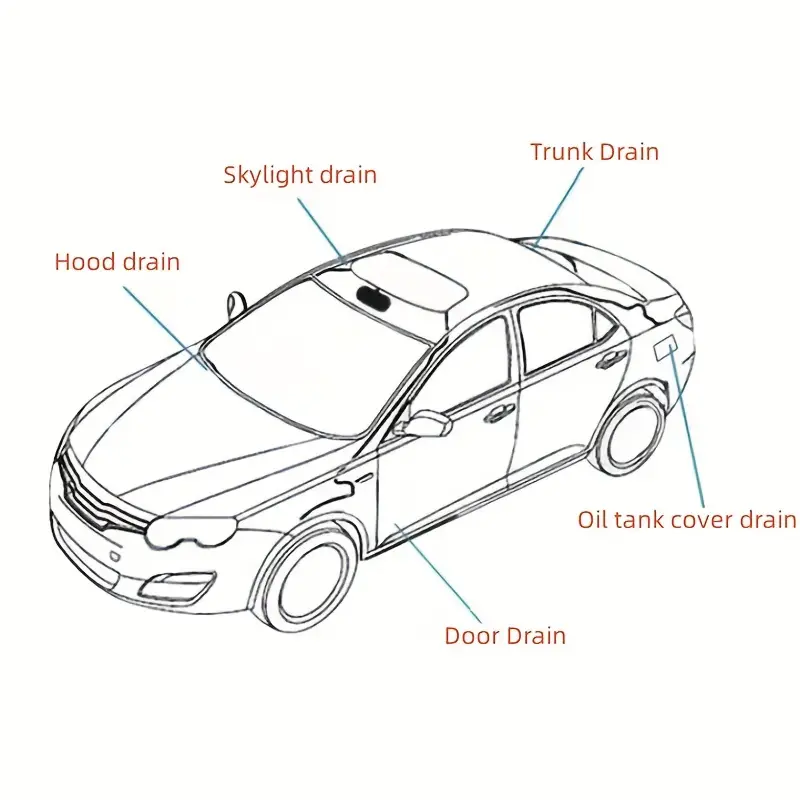

Pulitore Di Scarico Del Tetto Apribile Dell'auto, Pulitore Di Scarico Della Porta Dell'auto, Pulitore Di Scarico Del Frigorifero, Spazzola Per La Pulizia Del Tubo Di Scarico Del Serbatoio Del Carburante - Temu