Soffione Doccia, Soffione Doccia Anticalcare con Filtro Anticalcare Doccia, Doccino per Doccia con Anticalcare Doccia, Doccia Soffione Alta Pressione con Tubo Doccia, Filtro Doccia Anticalcare, Nero : Amazon.it: Fai da te

Colonna doccia quadra in acciaio regolabile con miscelatore termostatico doccetta anticalcare e soffione ultraslim 20X20 cm | Arcshop | Arredo Bagno Online

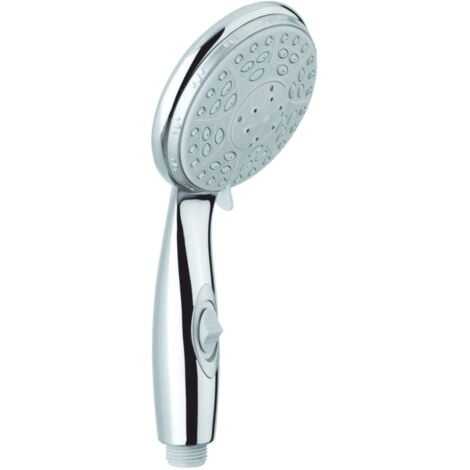

Rainsworth Soffione Doccia con Filtro H36807, con Tubo 150cm, Doccino per Doccia Anticalcare, 3 Funzioni Soffione Doccia Alta Pressione Doccino Anticalcare, Ammorbidire l'Acqua Dura, Cromo : Amazon.it: Fai da te

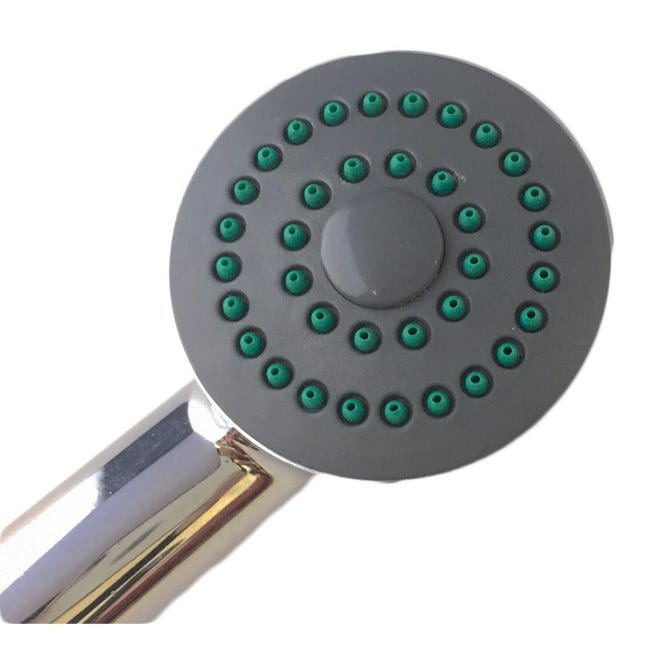

Rainsworth Soffione Doccia con Filtro, Doccino per Doccia Anticalcare, 3 Funzioni Soffione Doccia Alta Pressione Doccino Anticalcare, Ammorbidire l'Acqua Dura, Nero : Amazon.it: Fai da te

BSITSSS Soffione Doccia Anticalcare,Doccino per Doccia 5 Modi Funzione Soffione Doccia Alta Pressione Risparmio Idrico,Universale Soffione per Doccia Soffione Doccetta per Doccia Doccino Pressurizzato : Amazon.it: Fai da te