AFASOES Chiave per Svitare Candele con Impugnatura a T Chiave Snodata per Candele 16/22mm Chiave per Smontare Candele Moto Chiave a Doppio Snodo per Candela per Rimozione/Installazione delle Candele : Amazon.it: Auto

BES-27999 - Strumenti da Meccanico - beselettronica - Set rimozione candele 16pz candelette spezzate estrazione riparazione filetti

Candelette smontaggio Set di attrezzi 22 pezzi Set M8 e M10 chiavi smontaggio estrattore pignone per zuffe Candeletta punte penna a incandescenza automobili spezialwerkzeug : Amazon.it: Auto e Moto

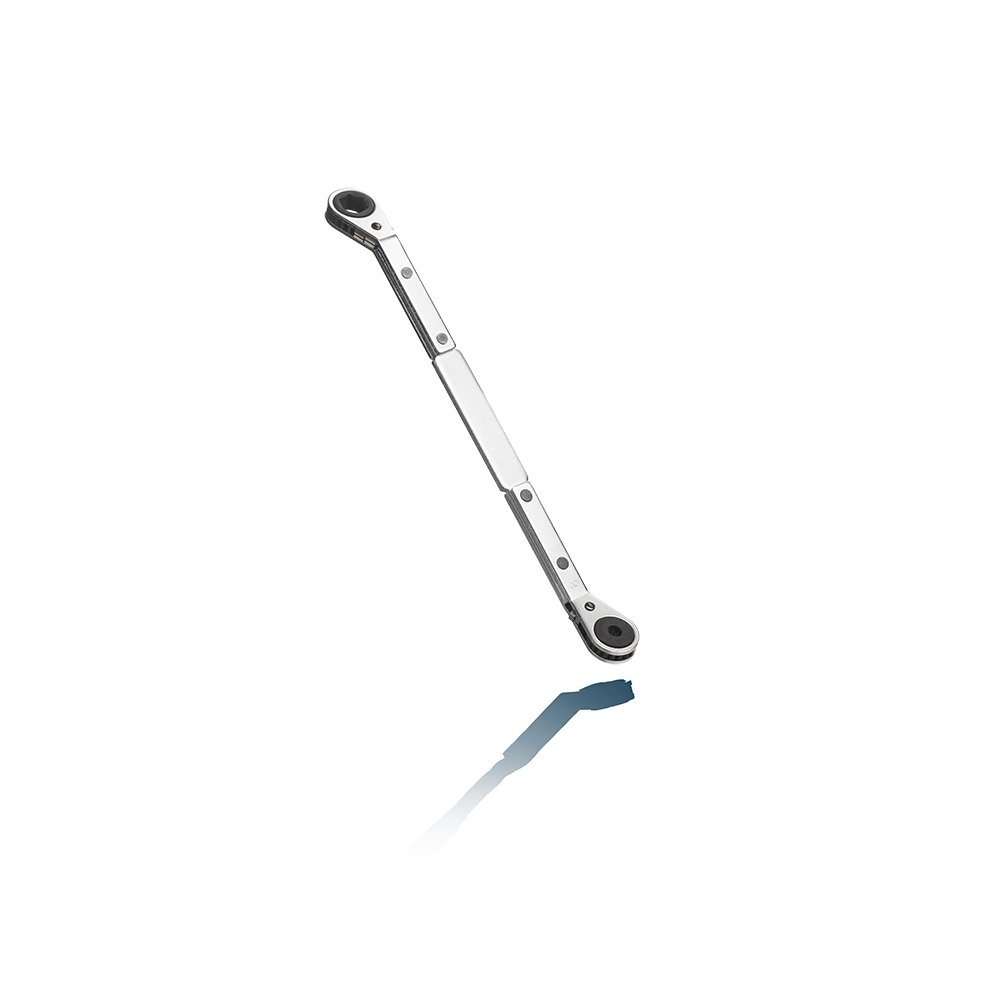

CHIAVI A SNODO PER CANDELA SERIE 6 CHIAVE SNODATE SMONTAGGIO CANDELETTE AUTO : Amazon.it: Auto e Moto