Eheim Filtro Esterno EccoPro 200 Modello 2034 600L/H 5W completo di materiali filtranti per Acquari Fino a 200 Litri | Aquariumline.com - Negozio Acquari

Oase FiltoSmart 200 - filtro esterno per acquari fino a 200 litri | Aquariumline.com - Negozio Acquari

Oase FiltoSmart Thermo 200, filtro esterno con termoriscaldatore per acquari fino a 200 lt - cod. 42668

Askoll 280285 Emotion PRO Nature LED 100 Nero con Filtro Esterno Pratiko 200, L, Nero : Amazon.it: Prodotti per animali domestici

Tetra EX 700 Plus Set filtro esterno completo, da 100 a 200 litri, silenzioso e a risparmio energetico : Amazon.it: Prodotti per animali domestici

Eheim Filtro Esterno EccoPro 200 Modello 2034 600L/H 5W completo di materiali filtranti per Acquari Fino a 200 Litri - 2034020

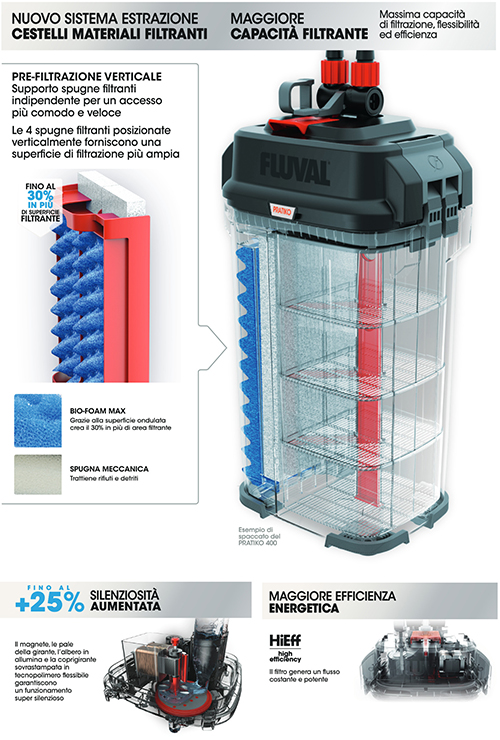

Askoll 212193 Askoll Pratiko 400 New Generation - Filtro Esterno per Acquari fino a 400 Litri : Amazon.it: Giardino e giardinaggio

Askoll Pratiko 220 3.0 Super Silent - Filtro esterno ad alta silenziosità per acquari fino a 220 litri - AquariumAngri

BPS (R) Filtro Acquario Professionale, Filtro Esterno a Zainetto per Acquario, Risparmio Energetico 3,2 W, 290 l/h BPS-6021 : Amazon.it: Prodotti per animali domestici